Let us promote

your upcoming esthetic event to

The Solo Esthetician® community.

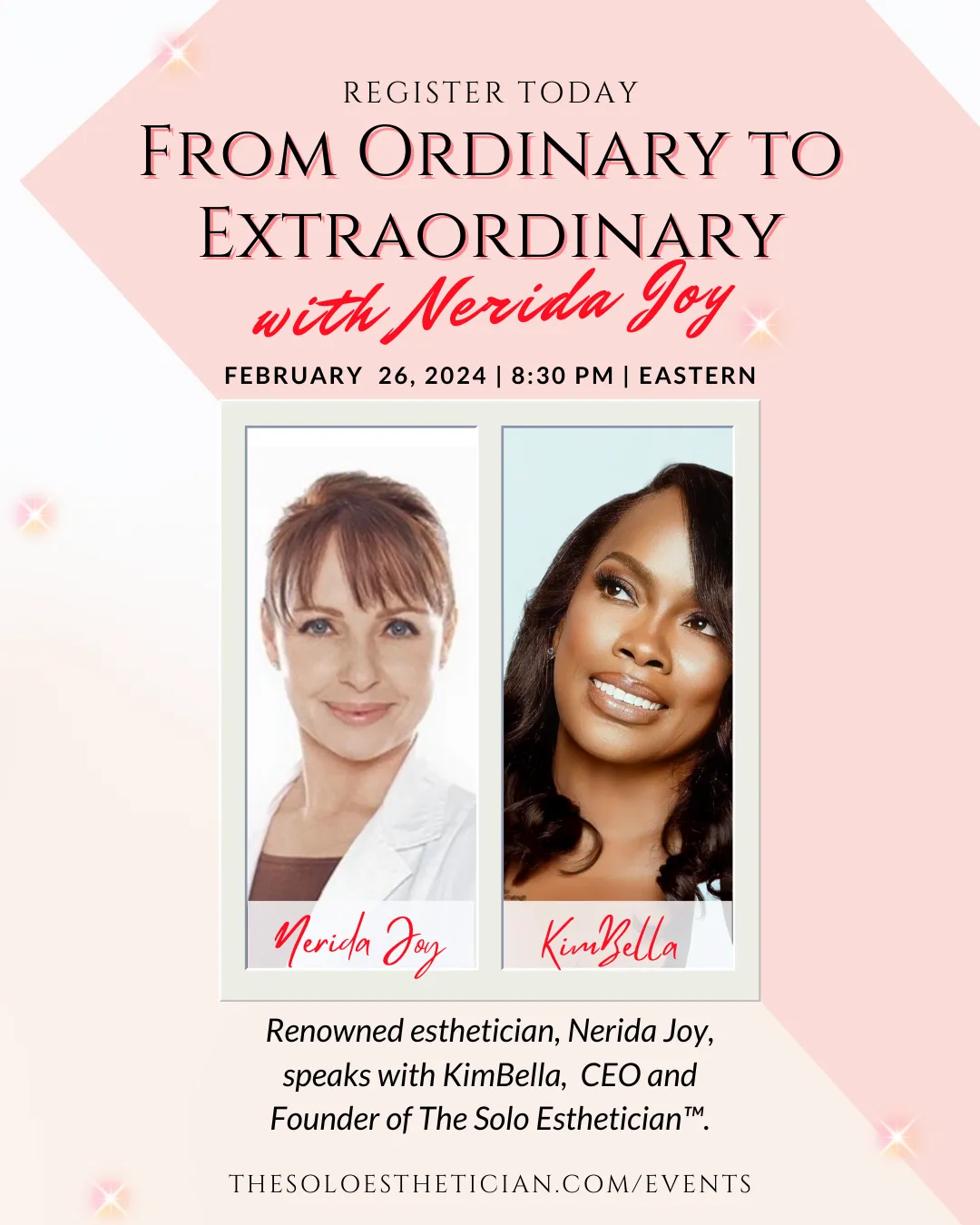

Promote your upcoming event to our community of more than 100,000 beauty professionals within our Facebook group, which includes both students and licensed estheticians. Take a look at some of the previous events we have been involved in. Seize the opportunity to connect with the esthetic audience necessary to ensure the success of your event!

We create blogs tailored for your brand's events.

The Importance of Bookkeeping Systems for Solo Estheticians: Pros, Cons, Statistics, and Examples

As a solo esthetician, managing your business can be both rewarding and demanding. Amidst all the tasks you handle, it is crucial to prioritize a robust bookkeeping system. In this blog post, we will explore why solo estheticians need to have a bookkeeping system in place, highlighting the specific advantages and disadvantages. We will also provide relevant statistics and examples to emphasize the importance of implementing such a system. Even if you cannot afford an accountant initially, we will discuss the option of finding a bookkeeping service tailored to solo estheticians. Let's dive into it!

Why Solo Estheticians Need a Bookkeeping System:

1. Financial Organization:

Maintaining a bookkeeping system ensures that your financial records as a solo esthetician are organized and accurate. This allows you to easily track your income, expenses, and cash flow, providing a clear picture of your business's financial health.

2. Profitability Analysis:

By implementing a bookkeeping system, you can analyze your revenue streams, identify your most profitable services, and determine which areas may need improvement. This knowledge helps you optimize your service offerings, pricing, and marketing strategies to maximize profitability.

3. Tax Compliance:

A bookkeeping system helps you stay compliant with tax regulations specific to solo estheticians. By keeping track of your income, expenses, and deductible items, you can easily calculate and report your taxes accurately, avoiding potential penalties or audits.

Pros of Implementing a Bookkeeping System:

Improved Financial Management. A bookkeeping system tailored to solo estheticians provides insights into your business's financial performance, enabling you to make informed decisions and optimize your resources effectively.

Streamlined Expense Tracking. Using software like Honeybook, allows you to accurately recording your expenses, including supplies, equipment, and marketing costs, you can evaluate your spending habits and identify areas where you can reduce expenses or allocate resources more efficiently.

Simplified Client Billing. With a bookkeeping system, you can easily track your clients' services, record payments, and send out invoices promptly. This streamlines your billing process and ensures you receive payments in a timely manner.

Cons of Not Having a Bookkeeping System:

Limited Financial Insights. Without a bookkeeping system, you may struggle to understand the true profitability of your services and overall financial position, hindering your ability to make informed business decisions.

Increased Risk of Financial Errors. Manual record-keeping or neglecting proper bookkeeping practices may result in errors in financial calculations, potentially leading to financial discrepancies and inaccuracies in your revenue reporting.

Tax Filing Challenges. Without proper bookkeeping, you may encounter difficulties in accurately reporting your income and expenses during tax season, which can lead to compliance issues and potential penalties.

Statistics and Examples

According to industry surveys, solo estheticians who implement a bookkeeping system experience improved profitability and are better equipped to navigate their finances effectively. Additionally, research shows that solo estheticians spend a significant amount of time each year managing their finances manually, which could be alleviated through proper bookkeeping practices.

Example:

Emily, a solo esthetician, diligently maintains a bookkeeping system that allows her to track her expenses, revenue, and profitability. By analyzing her financial data, she realizes that offering a specific skincare package brings in substantial revenue and decides to promote it more prominently. This strategic decision helps her attract more clients and boost her overall profitability.

Finding a Bookkeeping Service:

If hiring an accountant is not initially feasible as a solo esthetician, consider outsourcing your bookkeeping to a specialized service for solo estheticians. Many affordable options are available, ranging from virtual bookkeepers to user-friendly software designed specifically for the beauty industry, such as Solo Beauty Pros.

Events: Pretty Profitable with Solo Beauty Pros:

Free Training on February 13th and 27th, March 12th and 26th, and April 9th

Join Meagan Smith, founder of Solo Beauty Pros, for a free live training on how to easily organize your finances and make tax time a breeze. Meagan is a former Esthetician and bookkeeper and has used her expertise in both industries to create the best financial tracking system for independent beauty professionals. Join us to make 2024 the year of less stress and more profit! Click here to register.

Conclusion:

In conclusion, as a solo esthetician, having a bookkeeping system in place is vital for the success of your business. It provides financial organization, profitability analysis, and ensures tax compliance. The benefits of implementing a tailored bookkeeping system for solo estheticians far outweigh the challenges. If hiring an accountant is not within your budget, explore the option of outsourcing to a bookkeeping service tailored to the unique needs of solo estheticians. Remember, investing time and resources in bookkeeping will contribute to your long-term success by helping you make informed decisions and ensuring the financial stability of your solo esthetician business.

Subscribe to TSE YouTube

Office: Atlanta, GA

Email: info@thesoloesthetician.pro

Copyright 2024. All rights reserved.